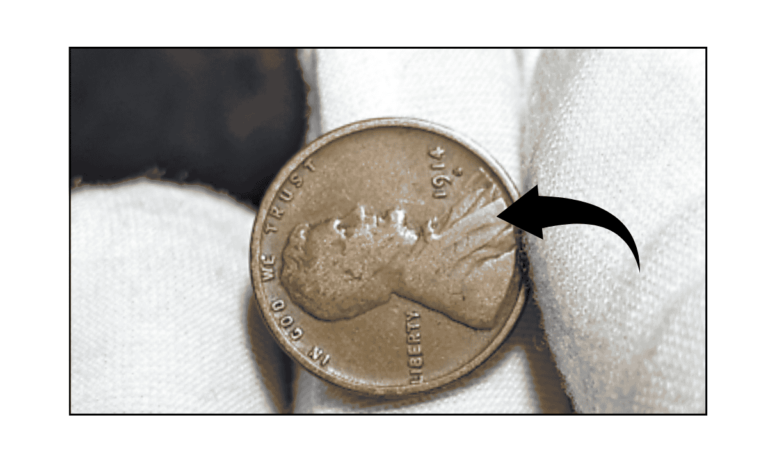

The Lincoln Wheat Penny Valued at $100K, Still in Circulation

Most people don’t think twice about pennies. They’re small, often overlooked, and only worth one cent. But what if we told you that one particular penny — a Lincoln Wheat Penny — could be worth up to $100,000? That’s right. …